Hi friends. This is girish once again.

Many of us know that there are many strategies available to trade in options . Many are confused to select which strategy to trade or not . Some wonder how the pro select strategy and trade .

Some pro select a particular strategy depending on their view and greek based and adjust according to view while some work on delta adjustments and some work on volatility.

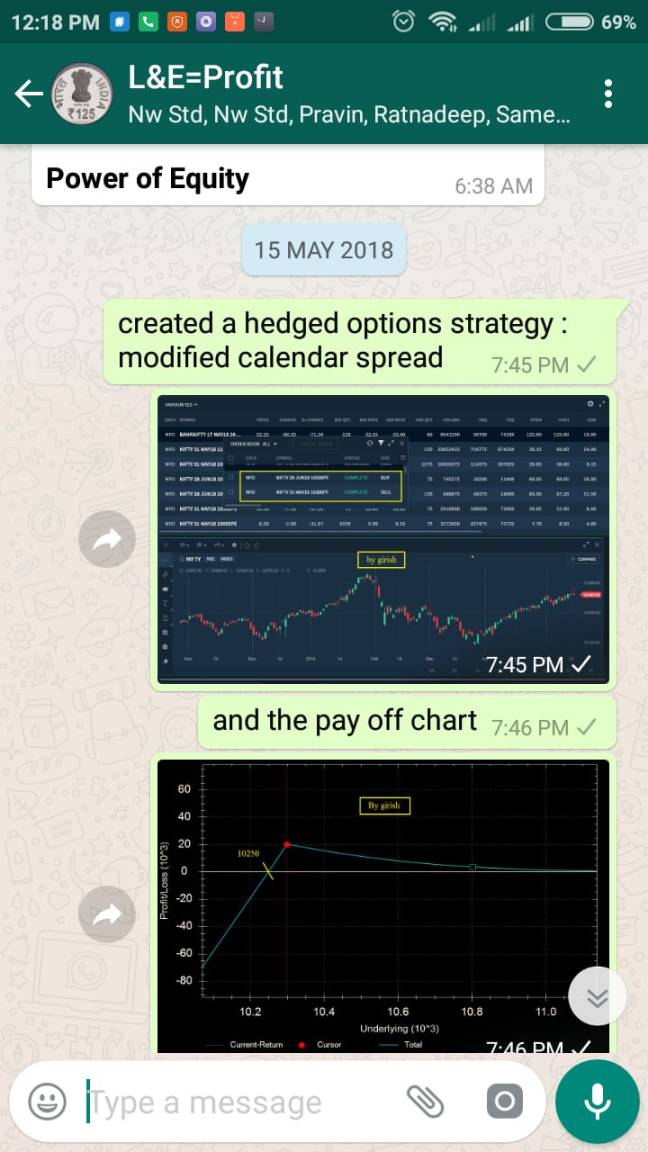

One another way is instead of adjustments, one can pre hand only create modifications in the traditional strategy which later require minimal or no adjustments. Here one needs to make use of the technicals .

Amateurs or the new comers in options need to understand that there is not a single holy grail options technique . One needs to work on a selected 2 or 3 strategy , adjust it or pre hand modify it . Such strategy then needs to be implemented as per technicals , greeks etc. Adjustments if required needs to be done . But one must know what kind of adjustments needs to be done for that particular strategy .

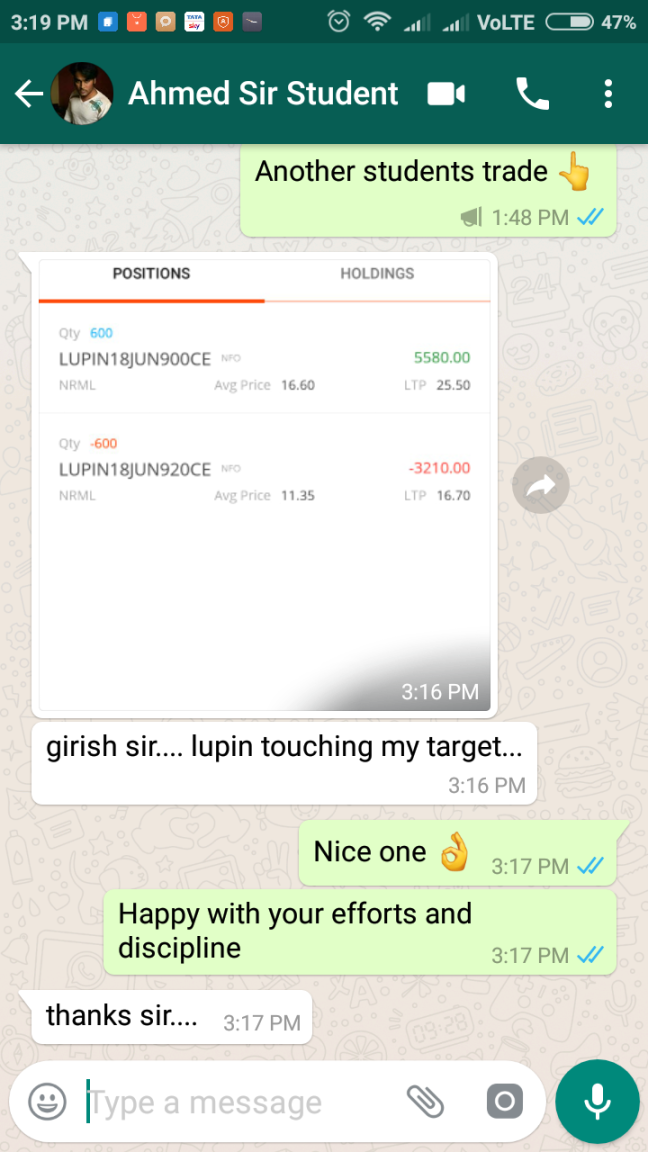

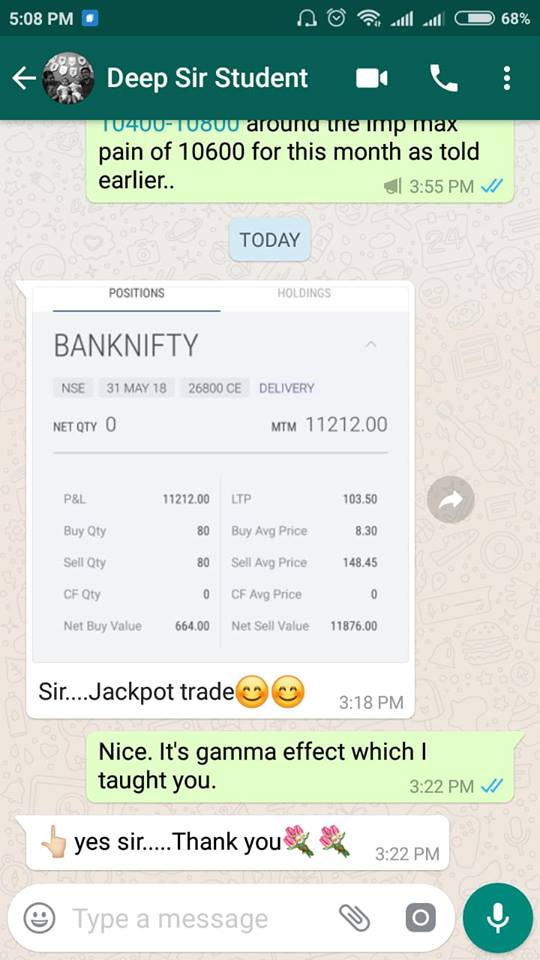

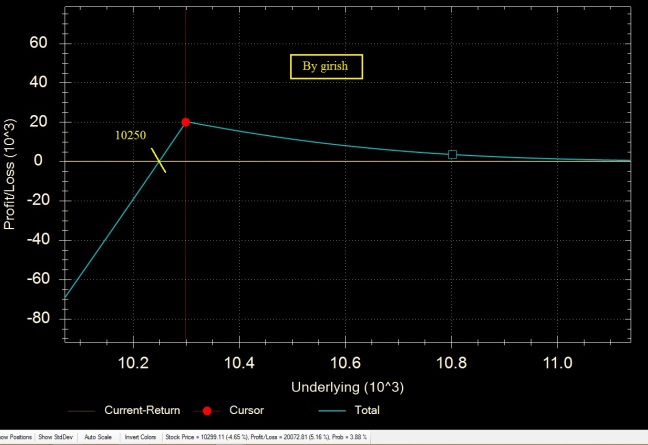

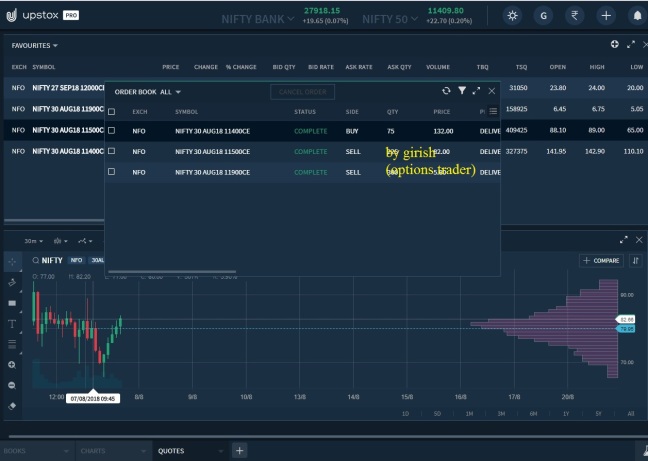

I will share one example of a modified strategy and it was traded as per technicals.

See the image below

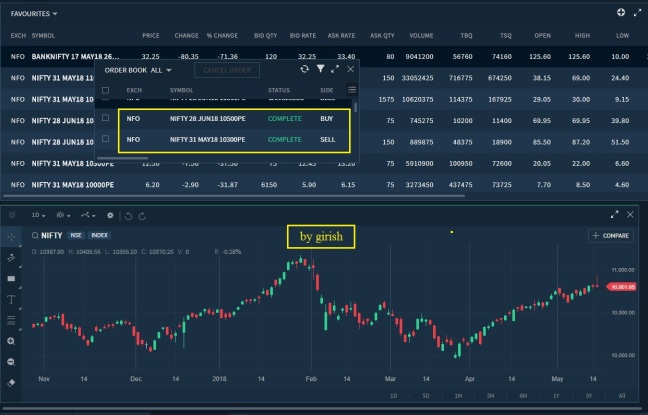

To maintain patience for a little upmove , i was also long on 11200 ce of september series .

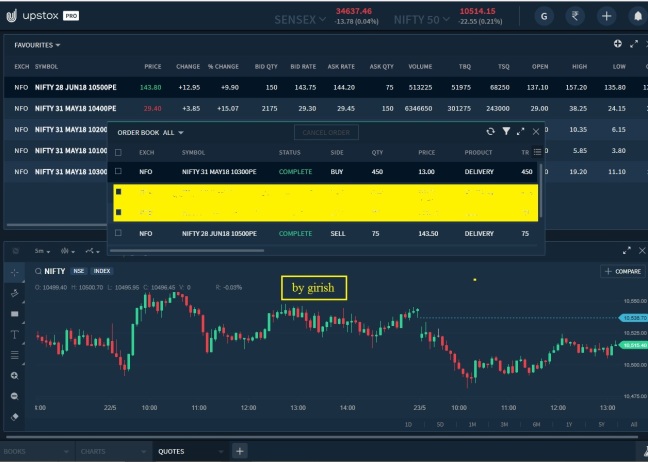

Later on nifty went up and it showed a reversal . See the nifty daily chart below

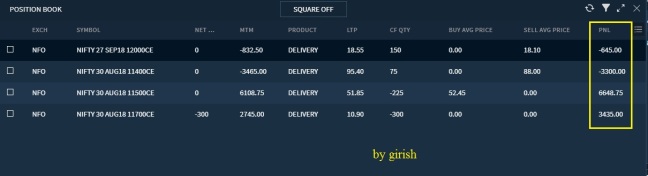

After the reversal signal confirmation , i shifted my position from 11900 ce to 11700 ce depending on the basis of price action.

Next day the market fell down and i covered my position .

Now my capital is free and once again i can work on another strategy to make further profits .

The main purpose was to show the amateurs that options require skill and proper knowledge to make money on a consistent basis . There is nothing like fancy or every day or every month jackpot in options . Making small and consistent returns safely every month and keeping on compounding is the key required to become a successful trader no matter whether one does delta adjustment in options , position adjustments , volatility trading , pre modified strategies etc.

Friends i am providing my own views. You plz trade as per your own views. Don’t blindly follow me .

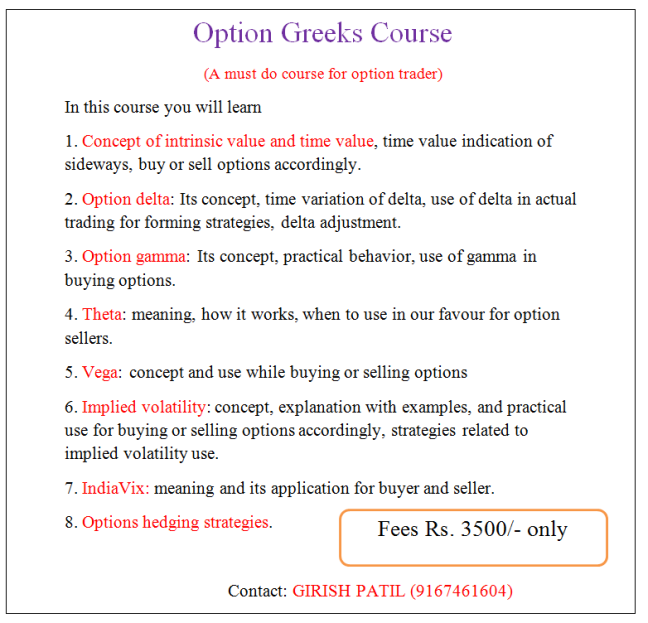

TO LEARN MORE ON PRICE ACTION AND OPTIONS TRADING

CONTACT ( GIRISH PATIL : 9167461604 )

TO KNOW COURSE DETAILS AND FEES VISIT