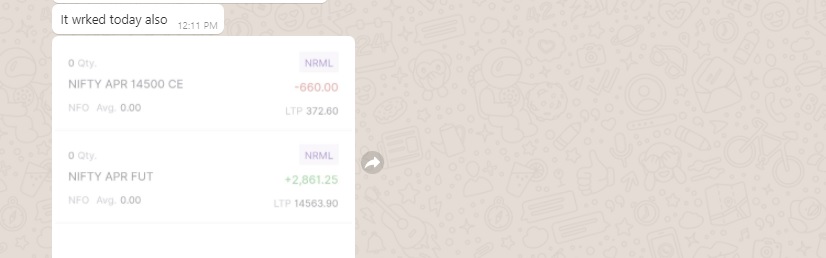

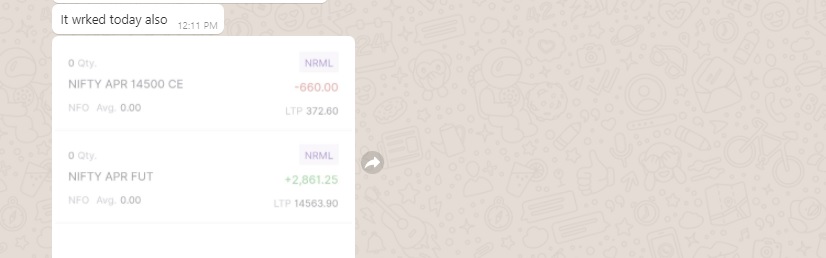

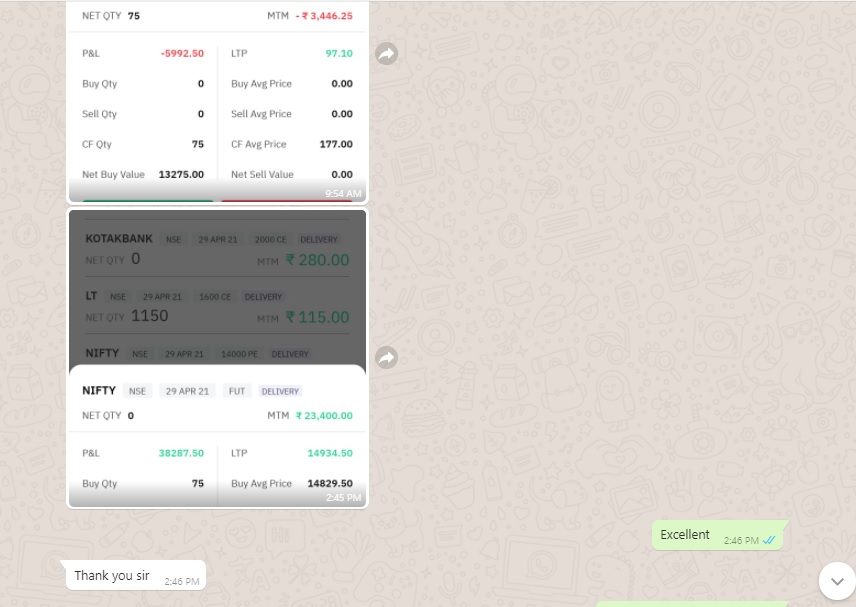

Student 1 trade :

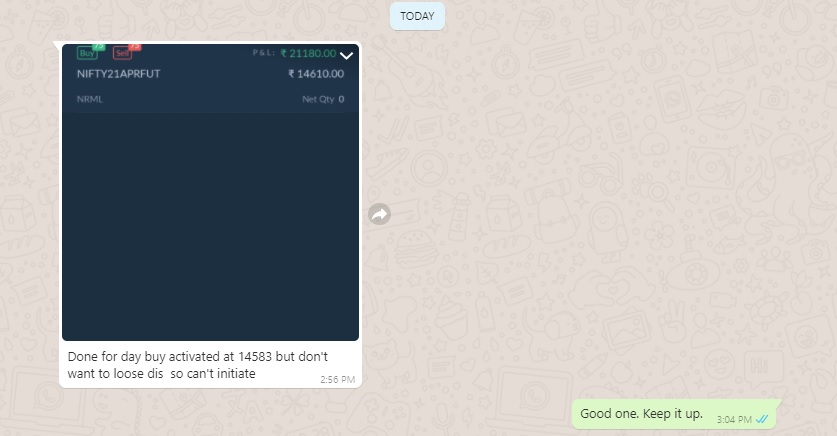

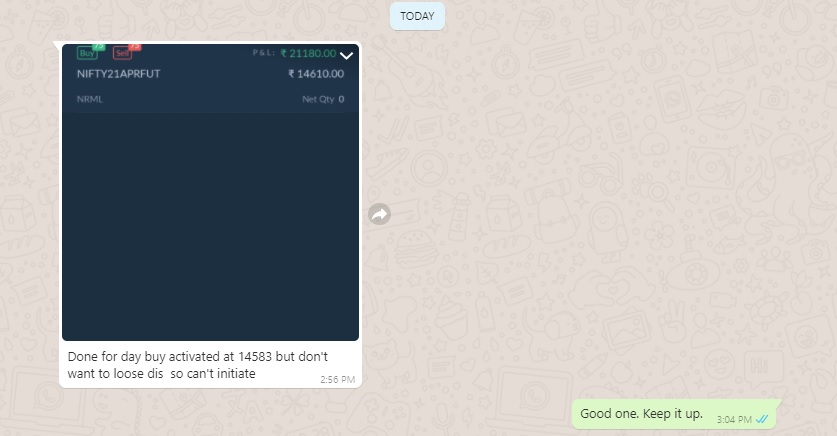

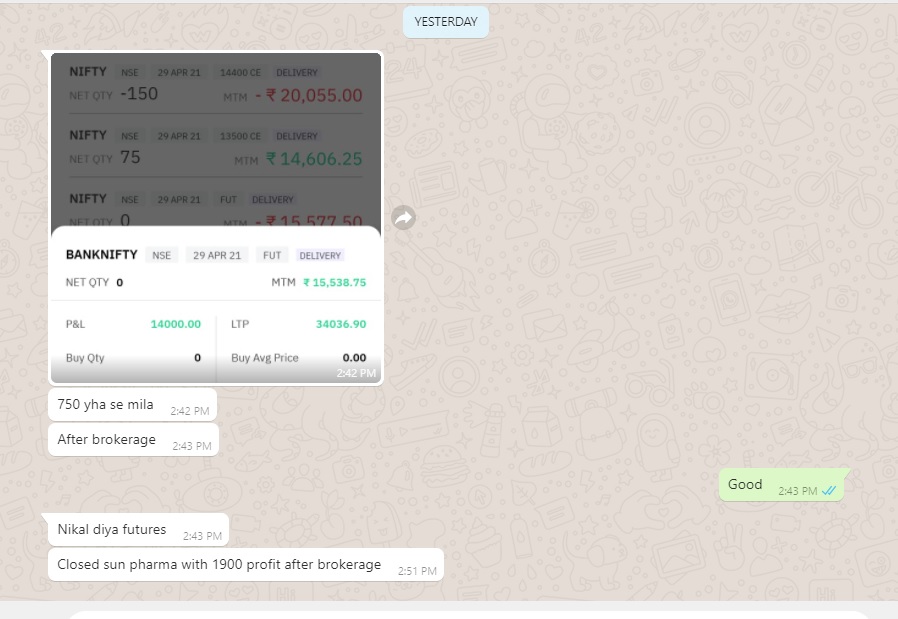

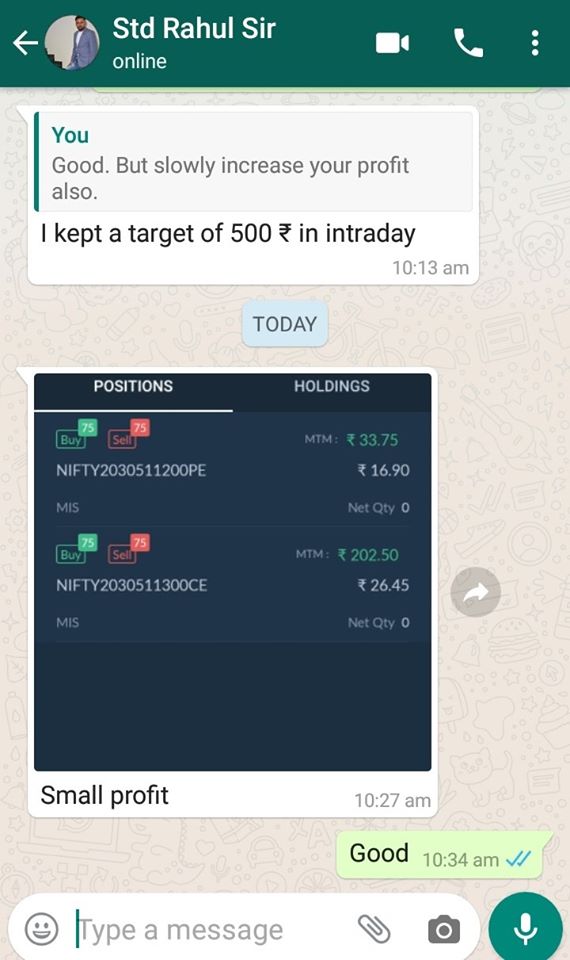

Student 2 :

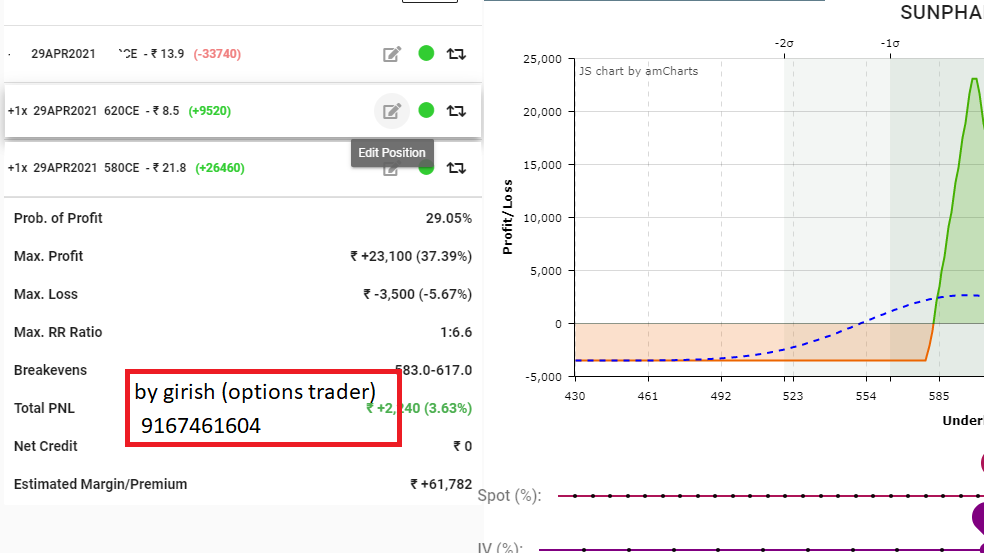

TO LEARN MORE ON PRICE ACTION AND OPTIONS TRADING

CONTACT ( GIRISH PATIL : 9167461604 )

TO KNOW COURSE DETAILS AND FEES VISIT

Hi friends. This is girish once again.

Plz check the below attached image.

Nifty is now entering into the support zone as per daily chart .

One thing to observe is that the price is away from the moving average as well as India Vix has rosen a lot .

Put option buyers who are now in profit can sell otm pe to lock profits or those who want to buy put options can do debit spread strategy as put buying risk reward is not favourable now . This is because if market stays sideways or goes up, IV will met to decrease premium .

Friends i am providing my own views. You plz trade as per your own views. Don’t blindly follow me .

TO LEARN MORE ON PRICE ACTION AND OPTIONS TRADING

CONTACT ( GIRISH PATIL : 9167461604 )

TO KNOW COURSE DETAILS AND FEES VISIT

TO LEARN MORE ON OPTIONS TRADING

CONTACT ( GIRISH PATIL : 9167461604 )

TO KNOW COURSE DETAILS AND FEES VISIT

TO LEARN MORE ON OPTIONS TRADING

CONTACT ( GIRISH PATIL : 9167461604 )

TO KNOW COURSE DETAILS AND FEES VISIT

TO LEARN MORE ON OPTIONS TRADING

CONTACT ( GIRISH PATIL : 9167461604 )

TO KNOW COURSE DETAILS AND FEES VISIT

Hi friends. This is girish once again.

Gamma an options greek plays an important role in helping to earn more profit in options buying . One needs to understand it and use accordingly .

Jackpot trades can be earned on expiry day ( not every expiry day ) but needs a strong discipline and good practice of price action to time it .

One can see the below chart of put options .

Note : 1. this effect is best for otm options .

2. Gamma effect can vary from low to medium to jackpot profits .

3. Not every expiry is a jackpot . So don’t gamble and lose money unnecessarily.

4. This effect is best in Banknifty due to good volatility.

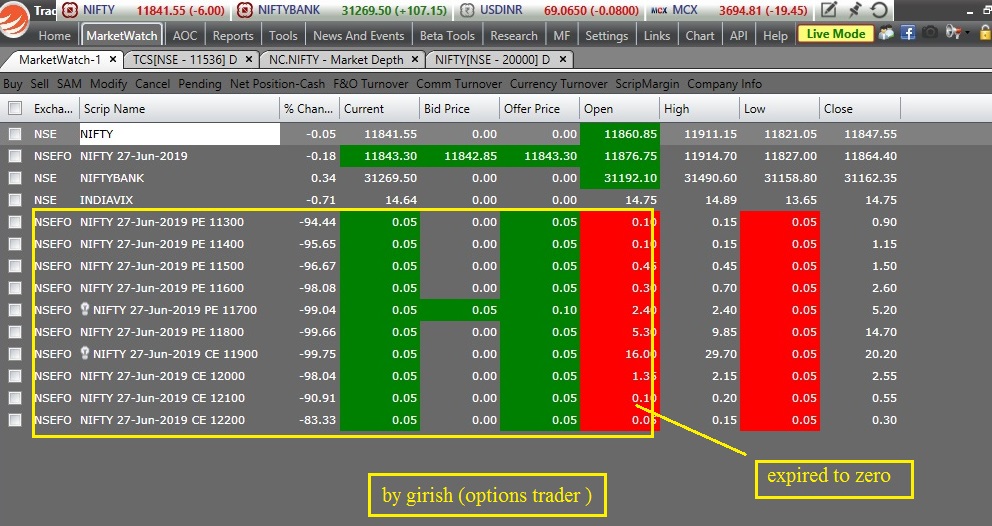

Hi friends. This is girish once again.

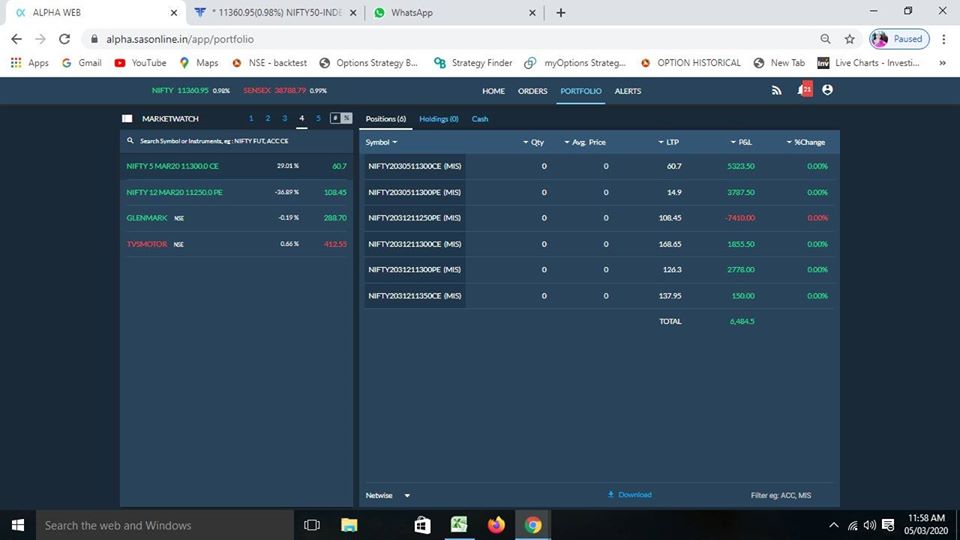

If you observe this whole month nifty was oscillated between 11500-12100 range as per the oi data . Many intraday voalitility were created attracting option buyers to buy options and hold for positional view . Sadly at the end , most of the options expired worthless .

See the image below .

One must therefore should not hold options till expiry . Even the itm lost their time value .

One must buy options from a swing trading point of view . Holding for 2-4 days . Exit with SL . Don’t be stubborn in options buying . Also don’t buy options on hope or hold options on hope .

Friends i am providing my own views. You plz trade as per your own views. Don’t blindly follow me .

TO LEARN MORE ON OPTIONS TRADING

CONTACT ( GIRISH PATIL : 9167461604 )

TO KNOW COURSE DETAILS AND FEES VISIT